Trading Bot Development – Smart, Secure, and Always Ahead of the MarketAutomated Trading Bots That Think Faster, Trade Smarter and Never Sleep

At Ixooweb, we develop custom trading bots designed to execute lightning-fast trades based on real-time data and market strategy. Whether you’re trading crypto, forex, stocks, or NFTs, our bots work around the clock—analyzing, predicting, and executing trades with precision and speed.

We build bots that don’t just automate trades—they help you gain an edge in even the most volatile markets.

High-Performance Trading Bots Built for Speed Strategy Scalability

Why traders and hedge funds choose Ixooweb for trading bot development:

✔ Multi-Platform Support – Binance, KuCoin, Bybit, MetaTrader, Polygon, DEXs & CEXs

✔ Strategy-Based Development – Grid, scalping, arbitrage, trend-following, or fully custom

✔ Real-Time Data Feeds – WebSocket, REST, oracles, and live chart analysis

✔ High-Frequency Trading (HFT) – Ultra-fast execution with low latency

✔ Risk Management Logic – Stop-loss, trailing stop, take-profit, and capital limits

✔ Backtesting Engine – Test your strategy on historical data before going live

✔ Custom Dashboard – Monitor trades, performance, logs, and make real-time tweaks

#1. Why Custom Trading Bots Make All the Difference

- Strategy-First Design – We build the bot around your approach—no one-size-fits-all solutions

- 24/7 Market Coverage – Bots don’t sleep, miss signals, or act on emotion

- Smart Indicators – Use RSI, MACD, Bollinger Bands, Moving Averages, or custom technical analysis

- DEX & CEX Integration – Trade on centralized or decentralized exchanges, or both

- Multi-Pair Monitoring – Scan and execute across multiple coins or symbols simultaneously

- Telegram/Email Alerts – Get notified of every trade or market condition in real time

- Fail-Safe Features – Auto-disable on volatility spikes, disconnects, or liquidity issues

- Cloud & VPS Ready – Deploy on AWS, DigitalOcean, or your own VPS

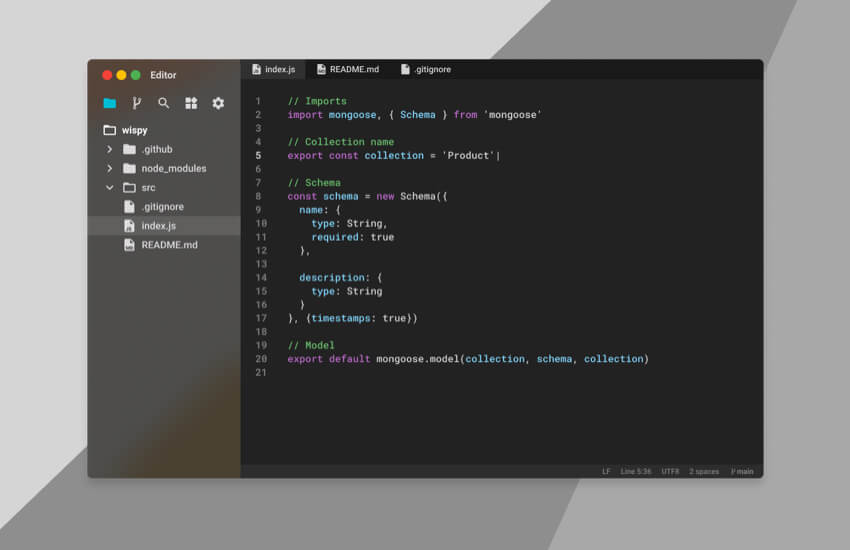

- Multi-Language Support – Python, Node.js, C++, or any preferred tech stack

- Custom UI or CLI – Use a simple interface or raw command-line control

#2. Our Process

-

Discovery & Strategy MappingWe define the core strategy, asset classes, exchanges, and risk profile.

-

Technical Architecture & Logic DesignWe translate your strategy into clean, optimized trading logic.

-

Data Feed & API IntegrationWe connect to your preferred exchanges using secured keys and real-time data streams.

-

Bot Development & SimulationWe build and test the bot in a sandbox environment using both live and historical data.

-

Performance Testing & TuningWe tweak the logic to improve risk-reward ratios, drawdowns, and win percentages.

-

Launch & SupportWe deploy on your preferred hosting and monitor performance post-launch.

#3. Why Choose Ixooweb IT Solution

-

Experienced8+ years of automation, with 3+ years in financial trading bots and crypto systems We’ve built scalping bots, grid bots, arbitrage bots, NFT sweepers, sniping bots, and market-makers Experience across Binance, Bybit, CoinDCX, PancakeSwap, Uniswap, MetaTrader, and more

-

Customer ServiceOne-on-one consultation to translate trading ideas into executable logic We explain each line of strategy logic—no black-box algorithms unless requested We support beginner traders and advanced quant developers alike

-

Support24/7 emergency monitoring (optional) Remote updates, feature additions, and strategy pivots Full training on how to modify, pause, or rerun the bot Help setting up VPS, exchange keys, and trading limits safely

#4. Frequently Asked Questions

We support almost any strategy: scalping, grid trading, arbitrage (cross-exchange or intra-exchange), mean reversion, trend-following, breakout detection, copy trading, and more. You tell us the logic—we’ll code it.

We integrate with all major exchanges via their official APIs: Binance, Bybit, KuCoin, CoinDCX, Uniswap, PancakeSwap, etc. We also support MetaTrader 4/5 for forex bots.

Yes. We can build one bot with multi-strategy capabilities or separate instances for different pairs or platforms.

You can run your bot on a local PC, but we recommend a VPS or cloud server for 24/7 uptime and speed. We’ll guide you through setup.

Bots follow logic—but market conditions can change. We implement strict risk controls, stop-loss, max drawdown limits, and testing to reduce risk. But no bot is 100% immune to losses.

#5. Case studies - Client success stories

Want to accelerate software development at your company? See how we can help.