Digital Banking Solutions – Secure, Scalable, and Built for the Modern Financial EraBanking That’s Not Just Digital It’s Smarter, Safer and Designed for Growth

At Ixooweb, we build custom digital banking platforms that redefine how financial institutions operate online. Whether you’re a fintech startup, cooperative, or a full-scale digital bank, we develop secure, user-centric banking systems—from KYC to real-time transfers and loan management.

From onboarding to transaction tracking, we engineer platforms that combine compliance, performance, and innovation—so your users get the trust of traditional banking with the speed of the modern web.

Custom Digital Banking Platforms That Are Fast Flexible Fully Secure

Why fintech startups and financial institutions trust Ixooweb with digital banking development:

✔ Banking Core Engine – Custom systems for account creation, deposits, withdrawals, transfers, and statements

✔ eKYC Integration – Seamless, automated verification with PAN, Aadhaar, or passport integrations

✔ Multi-Layer Security – Encryption, OTP, biometric login, and role-based access

✔ Instant Payments & Transfers – UPI, IMPS, NEFT, RTGS, and cross-border payment integration

✔ Loan & EMI Systems – Full lifecycle loan origination, disbursement, and repayment tracking

✔ User & Admin Dashboards – Real-time account insights, reporting, approvals, and audit logs

✔ Compliant Infrastructure – Built to follow RBI, PCI-DSS, and GDPR standards where required

#1. Why Custom Digital Banking Software Makes All the Difference

- You Control the Experience – Build trust with a UX that’s fast, intuitive, and reflects your brand

- Real-Time Everything – Balances, alerts, reports, transfers—updated the second they happen

- Designed for Scale – Whether you’re onboarding 100 users or 1 million, our architecture grows with you

- Regulatory Ready – We bake compliance into the design, so you’re audit-ready from day one

- API-First Approach – Easily integrate with external systems: credit bureaus, payment processors, government APIs

- Modular Design – Need micro-savings, virtual cards, or QR-based payments? We plug them in fast

- Custom Role Management – Define who can view, manage, approve, or override actions at any level

- Analytics for Growth – Actionable dashboards to track user behavior, deposits, and service usage

- Multilingual Interface – Serve customers in English, Hindi, or any local language

- Offline Capabilities – Need an app that works even with patchy internet? We can build offline-first experiences too

#2. Our Process

-

Regulatory Review & Strategy MappingWe assess your region’s compliance requirements and business goals to design the right approach.

-

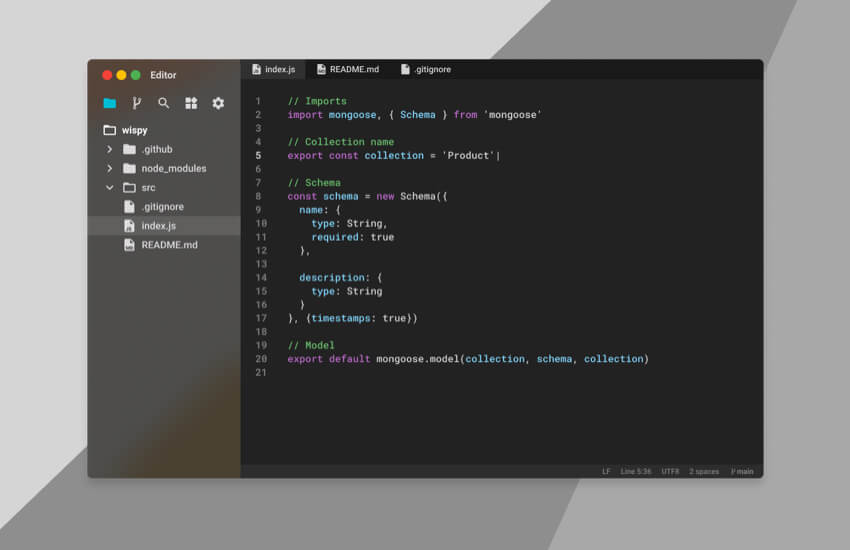

Architecture & Data Flow DesignWe create secure system designs with clear user flows, transaction paths, and access levels.

-

Custom UI/UX DesignModern, mobile-first interfaces that work perfectly across web and app environments.

-

Core Banking DevelopmentBuild account systems, transaction engines, balance checks, KYC/AML workflows, and more.

-

Security & TestingWe stress-test with penetration testing, failover simulations, and secure code reviews.

-

Launch & Audit SupportWe help deploy, integrate with banks/partners, and stay audit-compliant from day one.

#3. Why Choose Ixooweb IT Solution

-

Experienced8+ years in fintech and platform development, including work on lending systems, microbanking apps, co-op finance platforms, and KYC-integrated wallets Experienced with UPI, RazorpayX, Paytm Payouts, Yes Bank, Axis Bank APIs, and more We understand security, compliance, and how to scale financial apps the right way

-

Customer ServiceDedicated project manager who understands fintech, not just software Proactive communication and real-time milestone tracking We don’t just build what you ask—we advise you on how to future-proof your system

-

Support24/7 support for banking-critical issues Regular security patching, server monitoring, and load testing Custom training videos for your team and admins Help with third-party audits, RBI compliance, and investor documentation

#4. Frequently Asked Questions

Yes. We build full-stack solutions for digital-only banks, cooperatives, NBFCs, and micro-finance businesses. You’ll need regulatory approval, and we help you stay compliant from start to finish.

We implement encryption (AES, SSL), 2FA, biometric options, and comply with PCI-DSS standards. We also prepare your platform for third-party security audits.

Yes. We work with Digilocker, Aadhaar, PAN, and other government APIs for seamless eKYC, with proper encryption and audit trails.

MVPs (basic savings, KYC, transfers) take 6–8 weeks. Full-scale systems with EMI, loans, analytics, and admin portals may take 10–16 weeks. After our discovery call, we give you a clear roadmap.

Yes. We provide Android and iOS banking apps with real-time sync, biometric login, push notifications, and offline support.

#5. Case studies - Client success stories

Want to accelerate software development at your company? See how we can help.